2022 market overview: UK commerce and industry

Across the UK’s commerce and industry sectors, we’ve pulled together a review of the live data we have captured in 2022 – including London, Home Counties, West Midlands and South West England.

It was full steam ahead for HR recruitment in 2022

If you blinked, you may have missed 2022. It felt like a year where nothing slowed down and everything was full steam ahead, especially in the world of HR recruitment.

Now that we have a full year of statistics to analyse, it is clear that there were some extremely busy months this past year and some interesting hires across various sectors.

Coming out of the Covid years

For recruiters, the year-on-year cycle is usually similar. It’s generally predictable what the market will do, when its peaks and troughs will be, which sectors will grow or stabilise and where cutbacks might be.

The last few years have, however, been an exception to that rule. We literally had zero activity throughout 2020 – the start of the “Covid years” – and in 2021 we saw a slow and steady ramp up as the market reared its head. Q4 was becoming very busy indeed on the job front.

A 50% jump in jobs for January 2022

That led us nicely into January of 2022 when we started to see a substantial increase in jobs. The average number for this time of the year was already up by at least 50% to a “usual” pre-Covid year.

This didn’t slow throughout Q1 with new roles in the HR sector coming through thick and fast from our longstanding clients plus many new ones looking to hire into HR for the first time. The majority, around 55%, of new roles during Q1 were in talent acquisition (continuing from Q4 2021) and in the tech sector.

This inflated salaries in talent acquisition and especially tech due to the demand of experienced talent – which we all knew wasn’t sustainable for the long term. This was reminiscent of the 2007 financial crash (for those like me who remember recruiting in that time too) where we saw counteroffer after counteroffer. There was no second thought of offering an additional £10-20,000 to a candidate to secure them.

So, although the counteroffers were maybe not as high in 2022, this was probably because the initial salaries offered to TAs were already thousands higher than they needed to be!

The only way was up for Q2

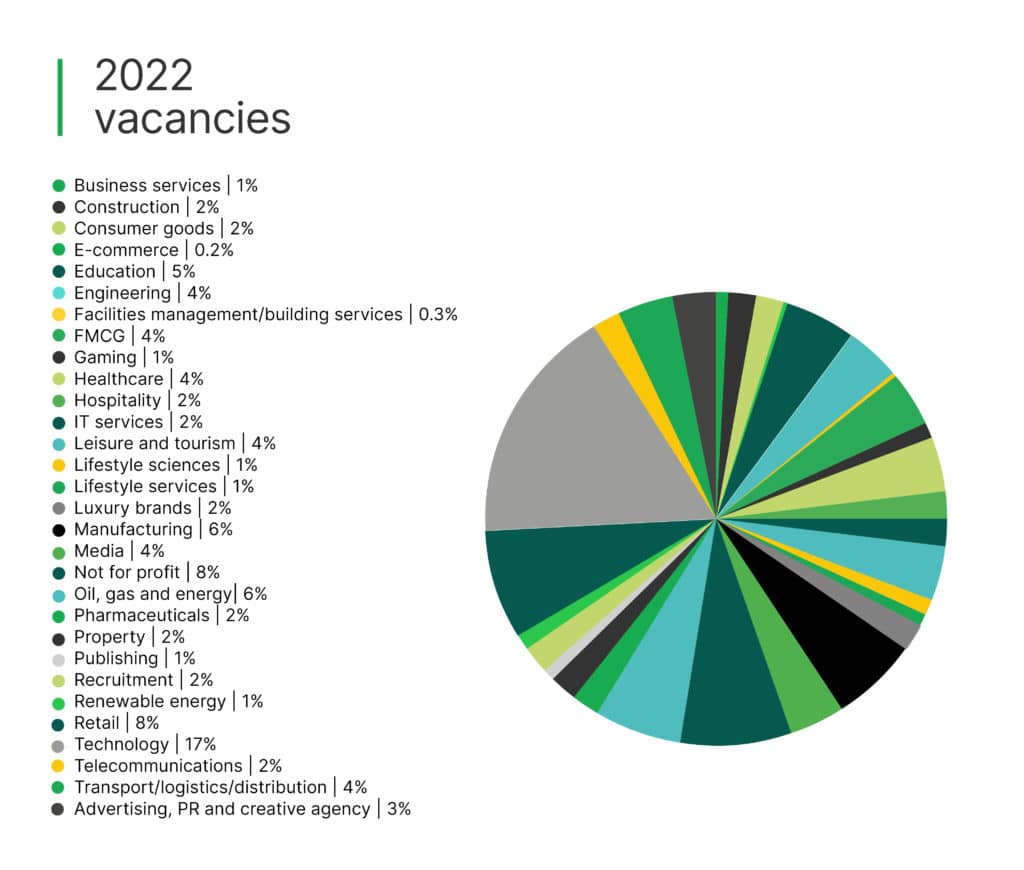

As we kicked off Q2, we saw continued growth and recruitment in most sectors within the commerce and industry area – including many start-ups who had secured funding and were creating new hires and HR teams.

In this start-up and business acquisition space, there was growth in sectors across renewable energy, PR and agency, tech, bio and life sciences. The fast-moving consumer goods (FMCG), hospitality, leisure and tourism sectors contained many businesses focused on new hires or direct replacements for those affected by Covid.

The manufacturing, transport, logistics and engineering space saw continuous and steady growth. Charity and non-profit sectors were also pretty stable throughout the year across all HR disciplines.

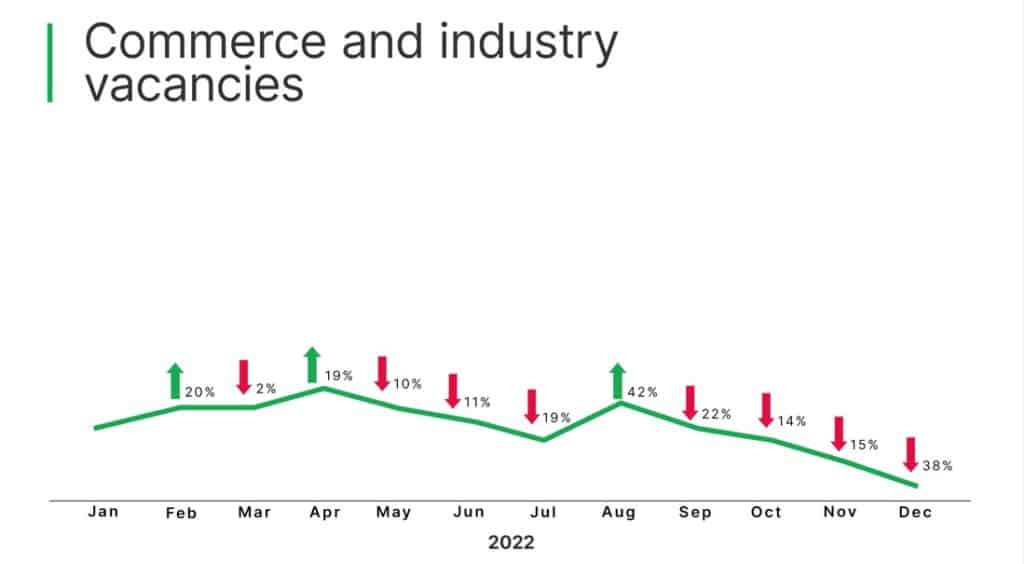

Reaching the peak in April

We saw hiring numbers peak in April and then flatten out for the rest of the summer with an unusual peak again in August, usually a month that everyone goes on holiday! This stayed incredibly high after summer as but started to slowly decline towards the end of the year.

From speaking to our network, we found this was mostly caused by a combination of budgets spent and caution going into a recession. This wasn’t necessarily driven by cutbacks, just interim hiring whilst waiting for the market to give good signals again to commit to permanent hires. There were also multiple sectors going through transformation, restructures and similar.

More seniors and varied roles for Q3 and Q4

The second half of the year also saw more interesting roles starting to come through, from Advisors and Business Partners to some big HR Director and CHRO level executive opportunities. These were UK-based and international with a large remit.

In Q3 and Q4, we also saw more roles across learning and development, reward and specialist areas such as transformation and change, and employee relations.

HR earning its seat at the table

It seems the UK market has been working hard to give HR a seat at the table this year by showing its true value. Businesses are realising that HR has led strategies and workforce planning, transformation and many other big-ticket items that warrant the recognition HR deserves.

Closing the UK’s salary gap

This enhanced perception of HR has driven a slight increase in its salaries across London and the rest of the UK. Interestingly, the gap between salaries inside and outside of London has shrunk due to remote and hybrid-working patterns. Businesses outside of London are attracting the city’s talent while London is frequently offering a hybrid model.

2023 begins

Now in January 2023, the market is still quite cautious but, although a little slow to start with, we are starting to see traction. We predict more caution for Q1 but we are optimistic that the UK market will bounce back and with a bang, so let’s see!

Keep an eye out for or monthly updates on what is happening in your market. Reach out to us if you’d like more detailed information on your sector or a conversation about your hiring needs or career.