January 2023 market overview: commerce and industry

Across the UK’s commerce and industry sectors, we’ve pulled together a review of the live data we have captured in January 2023 – including London, Home Counties, West Midlands and South West England.

The start of 2023 has been a pretty unpredictable one.

On one side, there has been a huge amount of activity on the job front which we’ve seen from direct adverts and speaking to our HR network. We’ve also seen a strong start to the year from many businesses with non-stop activity. However, we have also seen a fair amount of caution due to the economic climate and while there are high volumes of applications, they’re not necessarily quality applications.

“75% of interim roles were recruited by businesses who said they’ll probably hire this role permanently later in the year.”

An increase in interim roles

January is usually the reset for the year with a focus on budget and strategy setting, workforce planning, and understanding and predicting business needs.

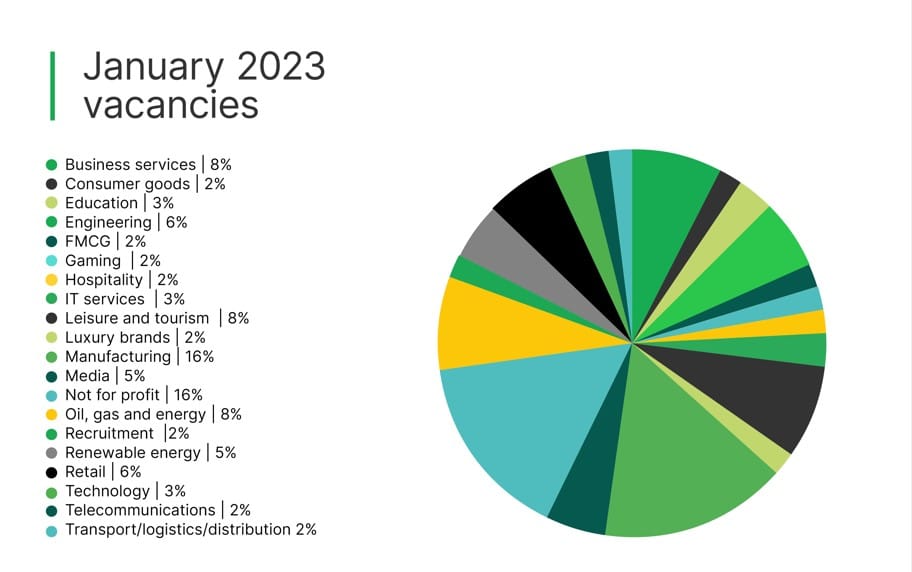

“The areas with the highest percentage of vacancies have been in the manufacturing and non-profit sectors.”

We saw a large increase in the number of contract roles at the beginning of January, mostly to fill a three to six-month gap. This gave businesses time to properly plan where they need permanent hires. Interestingly, 75% of interim roles were recruited by businesses who said they’ll probably hire this role permanently later in the year.

More vacancies in manufacturing and non-profit

Last year, we saw a huge increase in hiring into the start-up and scale-up tech sectors. We are already seeing that slow down as funding has been tightened, especially in the start-up market, so we have seen these businesses slow at present.

“The HR generalist market had 53% of the share of vacancies.”

The areas with the highest percentage of vacancies have been in the manufacturing and non-profit sectors, both with 16% of the market, followed by leisure and tourism, business services and the energy sector, all at 8%.

We analysed the split between roles and, as probably expected, the generalist market had 53% of the share of vacancies with payroll and talent acquisition (TA) roles at 16%, followed by employee relations, HR projects, and reward and benefits all at 5% market share.

When the job movement starts

As January continued, we started to see an increase in permanent job openings. January is the month when movement starts – bonuses are mostly paid at the end of the month and then we see the typical resignations spurring on movement in the world of recruitment into February and March.

“While there is caution, there are still positive messages around hiring.”

The businesses that hired in January were mostly in leisure and tourism (38%) and renewable energy sectors (41%). This is certainly positive in those business areas and there were still a number of other sectors hiring including tech, retail, fast-moving consumer goods (FMCG), life sciences, manufacturing, telecom and non-profit.

I don’t think anyone knows how this year will play out. But while there is caution, there are still positive messages around hiring. I predict we will see typical growth in the recruitment market in Q1, along with an uplift in available opportunities for businesses and professionals.

Get in touch today to discuss your hiring needs or career.