Global HR financial services job market: 2025 review and 2026 outlook

At Frazer Jones, we operate as one global team across financial services. Our HR recruitment experts collaborate seamlessly across all the locations we cover, combining global reach with deep local expertise. This unified approach enables us to share market intelligence in real time, deliver consistent and high‑quality search outcomes internationally and support clients with truly interconnected insights across regions.

2025: a year of strong growth

We experienced a 16% year‑on‑year increase in results across our global financial services practice in 2025, significantly outperforming the broader competitive market. As the largest specialist human resources executive search firm internationally, we work closely with boards, CEOs and CPOs every day. We continue to see the essential role HR leaders play in guiding organisations through an increasingly complex landscape shaped by technological advancements, regulatory pressures and the future of work.

Despite instability across global markets, HR hiring within financial services remained robust. Our teams across the UK, North America, Europe, the Middle East and Asia observed consistent themes shaping activity throughout the year. Recruiters across our global network also noted increased demand for future‑proof hiring strategies and high‑performing HR functions, particularly as the job market became increasingly competitive.

The evolving CHRO role

Geopolitical pressures, economic volatility, interest rate fluctuations and rapid technological advancements are reshaping how HR functions operate. The CHRO role is becoming more complex and increasingly in demand, requiring leaders to balance investment, cost and stability while driving performance, culture and employee experience across multi‑generational workforces. Many organisations are continuing to rethink workforce planning, hybrid work expectations and future‑proof their structures.

As organisations continue to rethink workforce planning and future‑proof their structures, CHROs are expected to demonstrate commercial influence, agility and foresight in navigating continuous change. Their influence across the C‑suite is becoming increasingly important, especially in shaping workforce‑wide decision‑making.

Strategic leadership and specialist hiring

The early part of 2025 saw restructuring across several markets, including instances of redundancies. Organisations prioritised must‑have strategic leadership appointments, confidential C‑suite hires and specialist roles such as executive compensation, board advisory, organisation design and employee relations. Time‑to‑hire extended as employers sought to assess criticality while still competing for top talent.

Short‑term caution around investment led to employees often taking on dual remits to alleviate headcount constraints. Interim and fractional solutions were used extensively, especially in the UK, while operating‑model reviews supported the move towards future‑fit and high‑performing structures.

Skills most in demand

Commercially astute and strategic CPOs remained highly in demand across all international regions. Reward, compensation and HR transformation specialists were also consistently sought after. In contrast, areas such as diversity, equity and inclusion and talent acquisition (excluding buy‑side markets) saw limited external opportunities until confidence improved towards year‑end.

Internal mobility continued to rise as organisations prioritised developing HR professionals and fully leveraging existing talent pools through upskilling, reskilling and mentoring initiatives. The pandemic accelerated many of these development programmes, further emphasising the importance of wellbeing and a strong employee experience.

Market activity across financial services

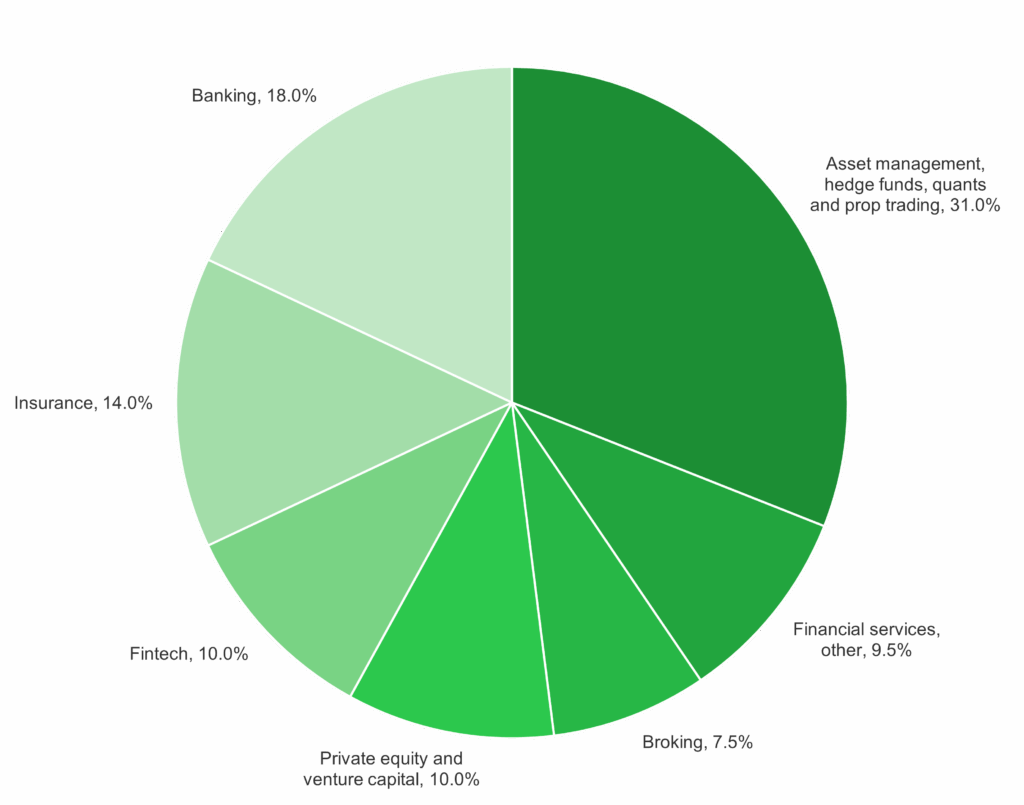

Our 2025 results, which often act as a barometer of global market confidence, showed a significant increase in investment across the buy side. Asset management, hedge funds and quant and proprietary trading accounted for 31% of revenue, driven by increased capital flows, a strong job market and heightened demand for specialist human resources expertise.

Banking and capital markets hiring remained steady and represented 18% of revenue. However, scrutiny around expenditure on the sell side increased, particularly within bulge‑bracket banks, where reduced hiring volumes and direct sourcing were notable themes.

Insurance (14%) and fintech (10%) hiring remained resilient, supported by acquisition activity and subsequent change‑related HR hiring. Private equity and venture capital hiring also grew, driven by sustained M&A activity and increased focus on ESG‑aligned leadership capability. These mandates typically began with CEO and CFO appointments, followed by CPO hires.

2026 outlook

The global economy is proving more resilient than anticipated despite periodic slowdown concerns. HR hiring across the financial services ecosystem is already gaining momentum. We expect a clear uptick in banking‑related HR hiring from late Q1 into early Q2, aligned with bonus cycles and increased investor confidence.

Private equity and the wider buy side are expected to continue expanding, supported by continued investment activity. Fintech remains well positioned for renewed growth due to rising investment appetite and transformation initiatives.

Regional hiring trends

The UK and Ireland remain highly competitive, particularly within the buy side, mirroring trends across North America and Asia.

Greater China has seen year‑on‑year growth in hiring demand, signalling renewed confidence across North Asia. Singapore continues to grow, though rising costs across regional headquarters have shifted some operations‑focused roles to lower‑cost markets such as Malaysia, the Philippines and India.

The Middle East continues to attract international talent, though nationalisation policies and economic pressures are reshaping compensation and hiring strategies.

Globally, salary increases are expected to remain modest at approximately 3.5–4.5% across major hubs. Employers in the US and EU are proactively addressing pay equity through compensation audits driven by regulatory pay transparency directives.

With voluntary turnover expected to remain low, organisations may take a more cautious approach to merit increases. Bonuses within banking and insurance are expected to remain flat, while the buy side continues to invest in innovative long‑term incentive structures to support retention of top talent.

HR priorities for the year ahead

CPOs are driving efficiency, performance management and accountability across their functions. Operating models are being redesigned and critical skills reassessed. Product knowledge within specific financial services verticals is increasingly important, particularly in front‑office‑aligned HR teams.

HR teams are also demonstrating their strategic value through data‑driven dashboards and insights, supporting cost optimisation, risk mitigation and commercial growth. Metrics and decision‑making frameworks are becoming increasingly important for organisations seeking greater transparency and certainty.

In 2026, more firms are implementing AI‑powered and AI‑driven tools to automate transactional workflows. These solutions support efficiencies while maintaining a human‑centric and compliant approach, aligning with evolving regulatory frameworks such as the EU AI Act. As a result, AI adoption, AI tools, data literacy and analytics capability are becoming essential.

Organisations continue to prioritise adaptability, upskilling and reskilling to address skills gaps. Targeted development initiatives help retain key talent, particularly middle management. Culture, purpose and strategic clarity remain central to a strong employee experience and retention. Wellbeing will continue to feature heavily as organisations address the needs of millennials and multi‑generational workforces.

Summary

Challenging market conditions are likely to persist through 2026. Financial services organisations must balance strategy with execution and innovation with culture to achieve long‑term success. Cost discipline, regulatory change and the governance and compliance implications of technology, digital assets and AI will continue shaping hiring decisions.

Investing in people, maintaining agility and moving quickly to secure top talent will be critical. The ability of CHROs and HR leaders to combine strategic insight with commercial acumen in a technical environment will define organisational performance.

We remain optimistic about the year ahead, supported by our strong global results and deep relationships across the financial services ecosystem.

Our global financial services salary guide and market report for 2026 will be published in late February 2026. It will provide data, insights and forward‑looking analysis to support decision‑making, compensation benchmarking and organisational transformation. To request a copy, please sign up below, or contact Charlotte Matthew or any member of our global financial services practice.

Our 2026 global financial services salary guide is launching soon! Sign up now for early access and stay ahead of the latest HR market trends.